Post Office Monthly Income Scheme (POMIS) is an investment scheme introduced by the Indian Postal service. This small savings scheme allows the investors to set aside a specific amount for five years investment plan. Subsequently, interest is calculated to this investment at the appropriate rate and paid out to the depositors on a monthly basis. post office to monthly income from Rs. 1000 to Rs. 9000 in this article.

Eligibility

Following individuals are eligible to avail the scheme-

- A resident of India. NRIs are not eligible to invest in this scheme

- Individual above the age of 10 years

Aadhaar and PAN Now Mandatory for POMIS

- As per a recent notification issued by the Ministry of Finance, it is now mandatory to provide your Aadhaar number and PAN to open a new POMIS account. If you have not been assigned an Aadhaar yet, you need to provide proof of application of enrollment for Aadhaar card or enrollment ID at the time of account opening and furnish the Aadhaar number to the accounts office within 6 months from the date of opening the account.

- If you already have an existing Post Office Monthly Income Scheme account and have not submitted your Aadhaar number, you need to do so within a period of 6 months with effect from 1st April 2023. Moreover, in case you have not submitted your PAN at the time of opening the account, you need to submit the same within a period of 2 months from the date of happening of any of the following events, whichever is earliest, namely:

- The balance at any given time in the account exceeds Rs. 50,000

- The aggregate of all credits in the account in any financial year is more than Rs. 1 lakh

- The aggregate of all withdrawals and transfers in a month from the account is more than Rs. 10,000

- If you fail to submit Aadhaar within the specified period of 6 months and PAN within the specified period of 2 months your account will become inoperational till the time Aadhaar number and/or PAN is submitted to the accounts office

Who Should Invest?

- Post Office Monthly Income Scheme is suitable for investors who are seeking fixed monthly income but are unwilling to take any risks in their investments. Thereby, it is more favourable for retired individuals or senior citizens who have landed into the no-more-paycheck zone

- It is suitable for the investors seeking a one-time investment to serve the purpose of getting regular income to maintain the lifestyle

- Investors willing to make long-term investments

Maximum Investment Amount in Post Office MIS

- Though there is no limit on the number of accounts held by individuals, there are limits on the maximum amount that can be cumulatively invested across all POMIS accounts.

- In case of sole operated account, maximum investment allowed in POMIS is Rs. 9 lakh

- In case of joint holders (up to 3 joint holders), maximum of Rs. 15 lakh can be invested in POMIS

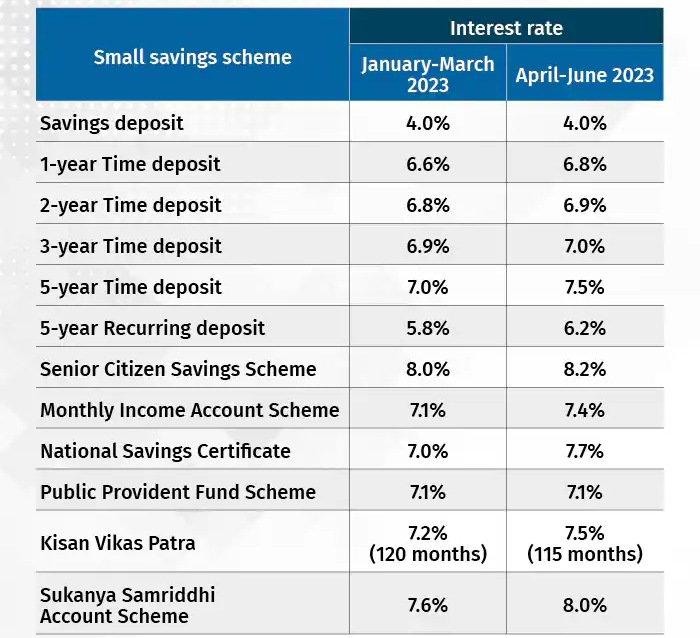

Current Interest Rates on Post Office Monthly Income Scheme

The Rate of interest is fixed and resettled by the Central Government and Finance Ministry every quarter depending on the returns yielded by Govt. bonds of the same tenure. The Post Office Monthly Income Scheme interest rate 2023 (October to December 2023) is 7.4%. The following are the historical Post Office MIS Interest Rates

Key Features of Post Office Monthly Income Scheme

Following are the key features of Post Office MIS plan:

1.Maturity Period – Effective 1st December 2011, the maturity period of the scheme is 5 years (60 months) from the account opening date

2.Number of Account Holders – POMIS accounts can be held individually or jointly (maximum three adult holders)

3.Minimum and Maximum amount of deposit – The minimum limit for the amount of deposit in Post Office MIS plan is Rs. 1,000 (and thereafter in multiples of 1,000)

The maximum limit for the amount of deposit in Post Office MIS plan is as follows:

| Type of Account | Maximum Limit |

|---|---|

| Single Account | Rs. 9 Lakh |

| Joint Account | Rs. 15 Lakh |

| Minor Account | Rs. 3 Lakh |

4.Nomination Facility – Nominee facility available and can be updated later after opening an account by a beneficiary (i.e. a family member). However, the beneficiary can only claim the benefits after the demise of the account holder.

5.Transfer Facility – POMIS accounts can be freely transferred from one Post Office to another.

6.Post Office Monthly Income Scheme Bonus – No bonus available on accounts opened on or after 1st December 2011. Accounts opened earlier were eligible for a 5% bonus on deposit amount.

7.Taxability – This scheme doesn’t come under the Section 80C of the Income Tax and it is subject to taxation. Moreover, it has no TDS either.

Documentation Required

- Identity Proof: Copy of government issued ID such as Passport / Voter ID card / Driving License/Aadhaar, etc.

- Address Proof: Government issued ID or recent utility bills.

- Photographs: Passport size photographs

How to Open a POMIS Account?

To open an account under Post Office Monthly Income Scheme, follow the steps given below-

- First, you must have a Post Office savings account. Open the same account if you do not have one

- Get an application form from your Post Office or Click here to download POMIS Account application form

- Fill and submit the form along with the self-attested copies of all the required documents at the post office. Note: You must carry the original documents for verification

- Mention the Name, DOB and Mobile no. of the nominees (if any)

- Proceed to make initial deposits (Minimum Rs.1000/-) via cash or cheque

Benefits of Post Office Monthly Income Scheme

- On the use of cheque for account opening, date of cheque realization will be account opening date

- In case of joint account, each account holder will hold equal share

- No limit on the number of POMIS accounts held singly/jointly. Subject to max. cumulative balance criteria

- A minor aged 10 years or above can avail the Post Office Monthly Income Scheme Account. On turning 18 years, he or she will be asked to convert his/her minor account to an adult account

- The Post office credits proceeds directly to the investor’s post office savings account on a monthly basis by ECS/CBS

- Post Office Monthly Income Scheme accounts can continue to earn interest for up to 2 years after account maturity if proceeds are not withdrawn by the investor. The applicable rate will be the same as that of a standard Post Office savings account

Monthly Income Plans vs Post Office Monthly Income Plans?

| Facility | Monthly Income Plan | Mutual Fund Monthly Income Plan | Insurance Monthly Income Plan |

|---|---|---|---|

| Introduction | Guarantees a fixed monthly income of 6.60% per annum. | A debt-oriented mutual fund that invests in equity-debt instruments in a 20:80 ratio | A type of retirement plan in which an annuity is paid to the insured as a monthly income |

| Convenience | For those who cannot bear any risk like old age and retirees | For risk-averse investors who want to be somewhere between safe and risky instruments | For those who want the dual benefits of insurance and investment |

| Monthly Income | Fixed and Guaranteed | Not guaranteed. It is based on investment returns | Fixed and Guaranteed |

| Deposit Limit | For Personal Account – ₹ 4.5 lakh For joint accounts – ₹ 9 lakh | There are no limits | There are no limits |

| Return | Fixed at 6.6% | Variable- Can shoot up to 14% or go negative at times | The objective of an insurance monthly income plan is to preserve and protect capital, not to maintain income |

| Lock in Period | The locking period is only 1 year after which the investor can withdraw the money, but not without 1-2% penalty charges. | Offers 1% exit load for cashing out units within 1 year of investment | Surrender charges are charged for withdrawing the amount before the policy term |

| Tax | TDS is not applicable but interest earned is taxable | TDS is not applicable | Monthly annuity payments are taxable |

Revised rate of interest in pomis

- In Post Office Monthly Income Plan, the monthly interest payment has increased from 8.40% to 6.60%. Prior to April 1, 2016, the interest rate was 8.40%. Here, it is important to know that interest income from this system is taxable. Additionally, one can invest up to ₹4,50,000 in the Post Office Monthly Income Scheme. This amount includes the share of joint accounts. The minimum deposit amount is ₹1,000, and deposits are accepted in multiples of ₹1,000.

Imporatnt Links

| Video Information | Click Here |

| Visit Homepage | Click Here |

Premature Withdrawal of the Scheme

- Premature withdrawal /closure of POMIS account before maturity period (5 years) is allowed subject to following terms and conditions:

- In case of premature withdrawal between 1 to 3 years of account opening, a 2% `deduction on deposit is applicable

- In case of premature withdrawal between 3 to 5 years of account opening, 1% deduction on deposit is applicable